KYC with regards to AML regulations is the process that financial institutions and businesses follow to verify the identity, suitability, and risks of a current or potential customer.

KYC is the process of collecting identification information and verifying its validity and legitimacy in order to establish and/or maintain a business relationship.

KYC regulations originated from years of unchecked financial crimes.

The initial guidelines were drafted in 1970 when the U.S. passed the Bank Secrecy Act (BSA) to prevent money laundering. Notable additions came years later, after the Sept. 11, 2001 terrorist attacks and 2008 global financial crisis.

Responsibility to undertake KYC Compliance are as follows

- Individual entrepreneurs, SMEs and large corporations

- Financial institutions

- Crypto-related businesses or enterprises

- Government regulators

The Purpose of KYC for the reporting entity is

- to understand who you are conducting business with to mitigate money laundering, terrorism financing and sanctions risks, and to comply with local and international regulatory requirements.

- to ensure that the funds involved in their transactions are originating from legitimate sources and used for legitimate purposes.

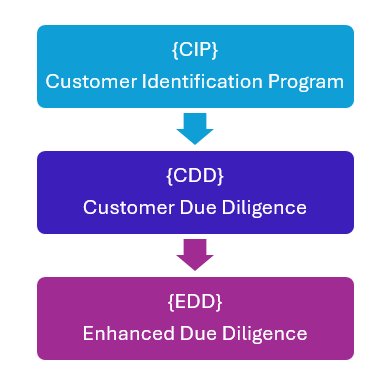

The “Know Your Customer” framework contains three steps:

As per Anti Money Laundering Laws in UAE KYC process is done before onboarding the clients.

The KYC process involves 2 main parts as follows:

1. Collection of identity information; and

2. Verification of that information via documentation.

![Know Your Customer [KYC]](https://amltickmark.com/wp-content/uploads/2024/04/know-your-customer.webp)